|

Understanding and Responding to Chargebacks

|

|

|

|

A chargeback is a payment dispute where a purchaser asks the bank that issued their credit card to reverse the charges for a purchase. Chargebacks are designed to protect consumers from fraudulent charges and unscrupulous vendors, but sometimes a customer will initiate a chargeback against a valid payment—for example, when they don’t recognize an item on their credit card statement or when they receive a partial refund for a cancellation when they believe that they should have received a full refund.

|

|

|

|

Ideally, customers who dispute a charge will call your organization directly to discuss and resolve the issue. But, if they immediately contact their bank to request a chargeback or if they don’t accept your explanation, your team must respond to the chargeback and submit evidence that supports your position that the charge and amount are valid. Chargebacks are costly—investigating and responding to chargebacks can be time-consuming, and your organization must pay a chargeback fee even if the bank agrees that the chargeback isn’t valid.

At Doubleknot, we’re doing everything we can to streamline responding to chargebacks. Our comprehensive chargeback portal makes it easier for your team to respond to chargebacks in a timely manner. All chargebacks against your Doubleknot account—regardless of the credit card type—are available for you to review and respond without ever leaving the familiar Doubleknot interface.

|

Investigating a Chargeback

When a chargeback is created, an email notification will be sent to everyone in your organization who has Financial Accounts permissions. We recommend that your team decide in advance who will be responsible for investigating and responding to chargebacks. When a chargeback notice is received, follow these general steps to respond (detailed instructions are in the next section):

-

In Doubleknot’s chargebacks portal, locate the new chargeback. The Reason field contains the reason for the chargeback (e.g., “Fraudulent”). To display the associated transactions, click Details. All the details for the disputed payment will be displayed.

-

Review all the transactions in the order to determine whether the disputed payment is legitimate. If the order details include a cancellation and/or a partial refund, you may need to find the policies for the event, ticket, registration or membership for the specific item in the order, and contact the team member who processed the cancellation and/or refund.

-

If possible, contact the customer to explain the reason for the charge. If the customer agrees that the chargeback is in error, ask them to contact their credit card company to remove the chargeback.

-

If you can’t resolve the issue directly with the customer, you must respond to the chargeback. Obtain copies of all relevant information including receipts, order confirmations, refund and cancellation policies and any other documents that establish that the charge is valid. And, write a clear, concise summary of why you are contesting the chargeback. Then, follow the steps below to respond in Doubleknot.

|

Preparing to Respond to a Chargeback

There are two important things to know before you dispute a chargeback in Doubleknot.

-

When you respond, you may attach one (1) file of supporting evidence. If you plan to submit a series of emails, receipts and/or policies, you must combine them into a single PDF, JPEG or PNG file first. (If you don’t have Adobe Acrobat, you can paste images of the supporting documents into a word processor file and then choose to save or print it as a single PDF.)

|

Responding to a Chargeback in Doubleknot

To respond to a chargeback, follow these steps:

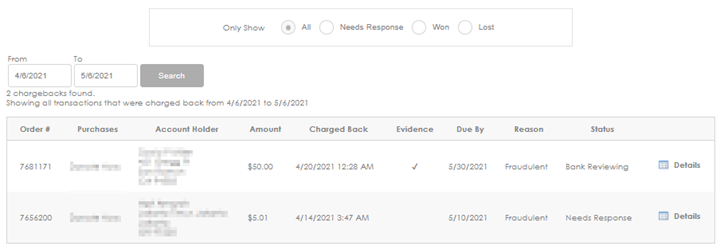

1. In Financial Accounts, click the Chargebacks tab, and then click Manage Chargebacks. The Manage Chargebacks page will be displayed. By default, all chargebacks will be displayed. You can choose to show only the ones that need a response, that were won or that were lost. You can also choose a desired date range. Chargebacks that match your criteria will be displayed. The Reason field contains the customer’s reason for the chargeback, and the Status field displays the current status (e.g., Needs Response, Bank Reviewing, Won or Lost).

|

|

|

|

The Manage Chargebacks page (partial view)

|

|

|

|

|

2. Locate the chargeback that you’re responding to (the status will be Needs Response), and click Details. The Transaction Detail page is displayed.

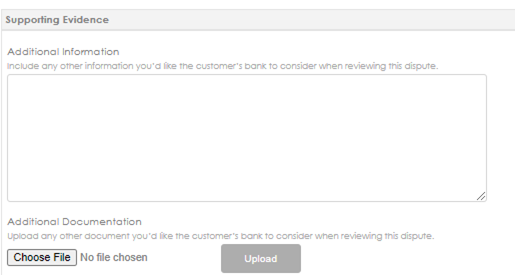

3. At the bottom of the page, click Dispute Chargeback. The Dispute Chargeback page is displayed. Scroll down to display the Supporting Evidence section.

4. In the Additional Information field, type (or paste) the description you wrote that explains why the charge is legitimate.

5. To upload a single file of evidence, click Choose File. (Depending on your browser, the wording may be different.) Navigate to the evidence file and click Upload.

6. Click Submit. Your evidence will be submitted, and the Manage Chargebacks page will be displayed. The status of the chargeback to which you responded will now be Bank Reviewing. You can return to this page to see whether the results of the bank review are in your favor (status is Won) or the customer’s (status is Lost).

|

|

|

|

Enter an explanation of why you’re disputing the chargeback, and upload one file of supporting documentation

|

|

|

|

|

|

|

|

|

| |

| |